Latest News

Bullhorn, ADP, Upwork and SmartRecruiters in the News

Thursday’s Bulletin

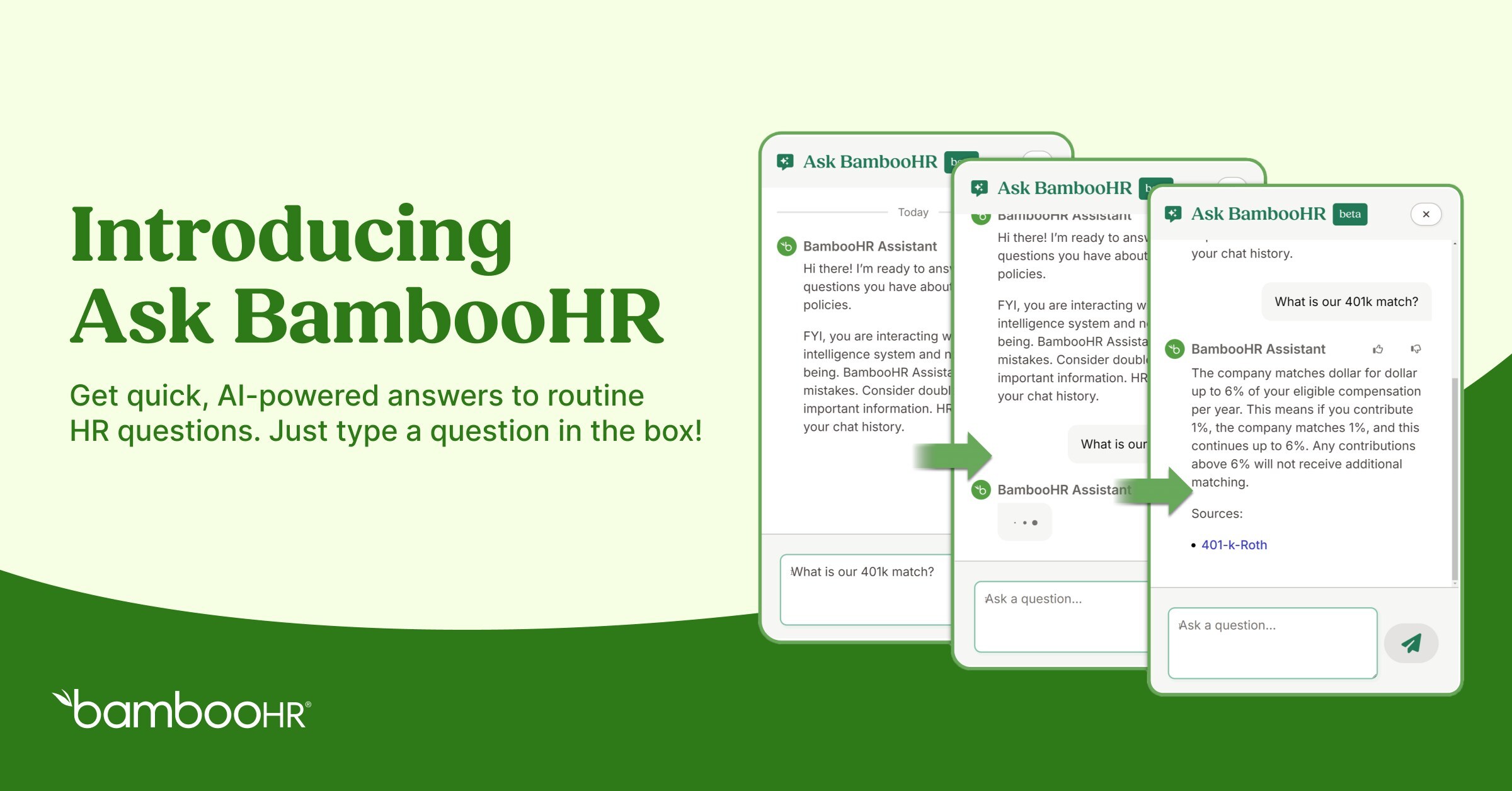

Ask BambooHR: Quick Answers for Employees, Reclaimed Time for HR

Best HRIS systems for small businesses

IAMPHENOM 2025 Registration Opens with Earliest Bird Pricing, Call for Speakers and Sponsors

Payroll management: Solutions, payroll processes, and best practices

Best HR software for startups

Bullhorn Ventures Invests in Staffing Referrals to Automate and Scale Agencies’ Referral Programs

Advisory Board Members to Help Guide HR.com’s Future of Payroll 2025 Research Study and Virtual Event

Ultimate Care Partners With DailyPay To Support Employee Financial Wellbeing

NEW YORK — Ultimate Care, a premier licensed home healthcare agency serving New York City and Westchester County, has partnered with DailyPay, a worktech company and leading provider of earned wage access. Within this partnership, Ultimate Care is modernizing its benefits offerings by providing the financial wellness benefit to empower all its employees accessRead More

The post Ultimate Care Partners With DailyPay To Support Employee Financial Wellbeing appeared first on DailyPay.

Paycor Announces Date of First Quarter Fiscal Year 2025 Financial Results

CINCINNATI, Oct. 16, 2024 (GLOBE NEWSWIRE) — Paycor HCM, Inc. (Nasdaq: PYCR) (“Paycor”), a leading provider of human capital management (HCM) software, today announced that it will release financial results for the first quarter of fiscal year 2025, ended September 30, 2024, after the U.S. financial markets close on Wednesday, November 6, 2024.